Crypto Loans - Should You Use Your Crypto as Collateral or Not?

In the recent time, multiple fintech platforms offering crypto loan and earning programs were rising. Their core value they provide are loans backed up by crypto collateral - which means that you can borrow fiat money (mostly Euro or Dollar) if you deposit enough of your crypto on their platform as collateral. They offer different interest and payback rates, which are cheap and flexible comparing to regular consumer loans, but they depend mostly on the Loan-to-Value rate they provide. What this means for you and why you put your crypto assets at certain risk using this platforms, I will now explain to you.

How do crypto loans work?

ℹ Crypto collateral backed loans mean that you have to put some of your crypto assets on the platforms account as a collateral, so you have to pay back your loans before you can access your cryptos again. To prevent you from additional funding obligations or increasing payback rates that you can not manage in case the crypto prices drop and your borrowed fiat has more value than your deposited crypto, these providers have certain Loan-to-Value (LTV) ratios that will define how much fiat you can borrow for your deposited crypto collateral. For example, if one provider offers a 50% LTV rate, this means you can borrow half of the value that your deposited crypto is at worth. It works the same as for mortgage.

❗ But here comes the problem: A mortgage collateral value is stable most of the time. Crypto instead is under certain risks or in other words highly volatil, which means that it drops and rises in price often, significant and unpredictable most of the time; of course some events like the corona crisis affects regular and crypto markets the same.

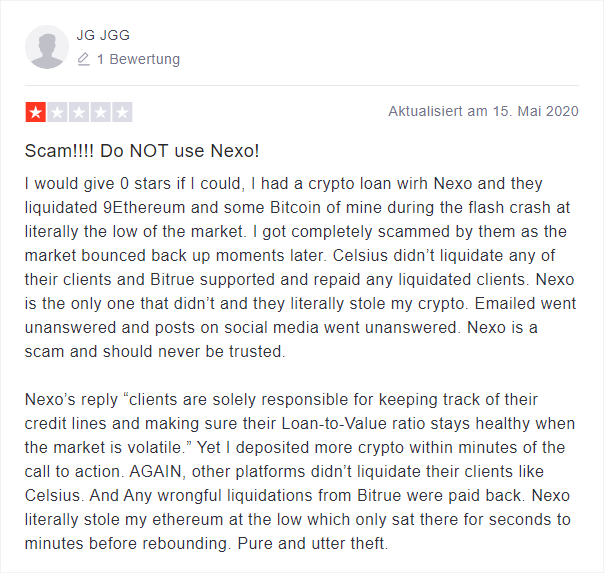

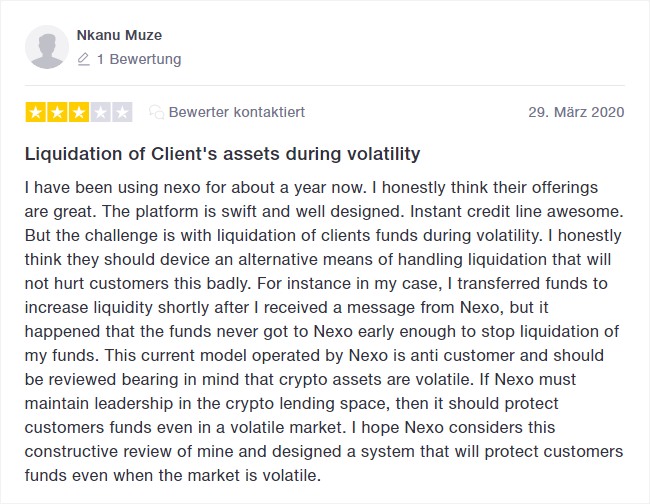

As for the corona crisis, this demonstrated how problematic these types of loans can be at certain providers. These providers have different LTV rates and liquidation policies regarding the time to meet their margin calls. Before applying to a crypto loan, read them carefully. Liquidation policies state what will happen with your crypto once your borrowed fiat value exceeds the deposited collateral. Not all providers offer clearly that your crypto will be at risk. There are providers that will liquidate your whole deposited crypto assets just directly after this threshold is passed, even if they state a margin call! Proof is given by the following reviews on trustpilot. They claim that they need to do so to secure their business. But regarding the high volatility of crypto currencies, shortly after such drop the value rises usually at the same speed again. This means that your whole assets will be lost just because of a temporary drop in value if you decide to use a provider with such policies! There where many users that have experienced this at the hard price drop if around 47% in march this year and lost their deposited crypto which they wouldn’t if they have chosen a provider with better liquidation policies or even a regular consumer loan.

Unsatisfied user of Nexo’s crypto loan program - https://de.trustpilot.com/reviews/5ebcf62725e5d209b8ea686c

Another unsatisfied user of Nexo’s crypto loan program - https://de.trustpilot.com/reviews/5e80a1e23c93ae06dc6be5f1

My recommendations

I would therefore recommend to choose a provider with lower LTV rates and read their policies carefully before applying to them. And never forget to check your crypto credit lines regularly because they update their rates and policies dynamically. You should therefore never apply to the whole value you could borrow and set your own LTV rate below the ones they advertise for.

On the other hand, in bullish times, you can keep the full value of your crypto assets and even profit from future increases in value without the need to liquidate them and still get some fiat in a short period of time if you need it. Consider to borrow only as much as you need so that you are not put at risk if the market turns bearish again (or just drops temporarily as we have seen before). They also won’t check your credit score or register your credit score tracking companies. Crypto lending therefore shares some of the characteristics of margin trading.

💡 Recommendation: Crypto loans aren’t the only program these platforms offer to you. Instead of borrowing money, you can even earn interest on your deposited coins - and the interest rates they pay, depending on your funds lock time, can be very high and get up to interest ranges of other kinds of invests like stocks or peer-to-peer loans, but at a significant lower risk. I think this is definitely worth it.

Popular crypto loan providers

Below, I will list popular crypto loan providers and their LTV and interest rates at the day of June, 6th of 2020. I also give them a risk score. It consists of the given time to meet margin calls and how clearly it is presented on the order pages that your crypto will be at risk. The score is just my opinion and should not be considered as a reliable source as they could update their rates and policies at any moment. Please take a look yourself into their policies.

| Platform | APR/Interest rate | LTV rate | Supported coins | Risk score | Link |

|---|---|---|---|---|---|

| Starting at 5.9% | ~ Depending on Asset; 52,7% for BTC | BTC, XRP, ETH, NEXO… | ⚠ High | nexo.io | |

| 8% - 12% | 50% | BTC, XRP, ETH, MCO… | ❓ | crypto.com (with free 50$ Referral Bonus) |

| 11.32% | Initial 65% - Liquidation 83% | BTC, XRP, ETH, LTC… | ⚠ High | binance.com (with free 10% Commission Bonus) |

| Starting at 4,5% | Initial 50% - Margin call 70% - Partial liquidation 80% | BTC, ETH, LTC | ✔ Transparent | blockfi.com |

| 1% Promotion | 25% for 1% APR Promotion | BTC, XRP, ETH, DASH… | ✔ | celsius.network |

| ~ 5,84% | Initial 50%-60% - Liquidation 80%-90% | BTC, XRP, ETH, USDT… | ✔ Transparent | bitrue.com |

Interest and LTV rates of various platforms

Thank you for reading and I hope this will help you on your decision for a crypto loan. If you want to apply to a loan or earn interest on your assets, you can use the links above to register at the platforms. Doing so, you will give me a small referral bonus 🙂